M&A Blog #07 – debt (Part II – management considerations, debt alternatives, and acquisitions purse / war chest)

Continuing with our home-buying analogy, when one buys a house, one should want to know how much mortgage loan s/he can get and the reasonable (lesser) amount that s/he should ultimately get. If the 2008 mortgage crisis taught us anything, it is not to get ourselves into situations where our homes can be taken away by the banks. That debt should be used prudently, taking into account future financial shocks that require financing flexibility. Similarly, a good M&A program has to take into account how each transaction and the overall program should be financed. We continue our debt discussion in this post by looking at management considerations on funding a M&A program. We will also go through a discussion on debt alternatives; along with an exercise to calculate the optimal size for an acquisition purse / war chest.

As an agent for the company, management should be aware that shareholders (equity holders) would want to leverage their equity to maximize returns while managing the amount of distress that excess debt will create. Company management’s considerations are more complex and should include:

Maintaining a reasonable level of operating flexibility

Limiting the stress on the capital structure from excess debt

Maintaining the financial capacity for attractive additional acquisitions

Maintaining excess debt availability to meet unanticipated liquidity issues

Maintaining the ability to fund capex and organic expansion

Borrowing at the lowest possible rate to keep good leverage ratio and credit rating

Maintaining access to debt markets and favorable lenders

Creating an attractive story for capital providers

Maintaining the ability to amortize term debt and payoff / refinance debt without an external transaction

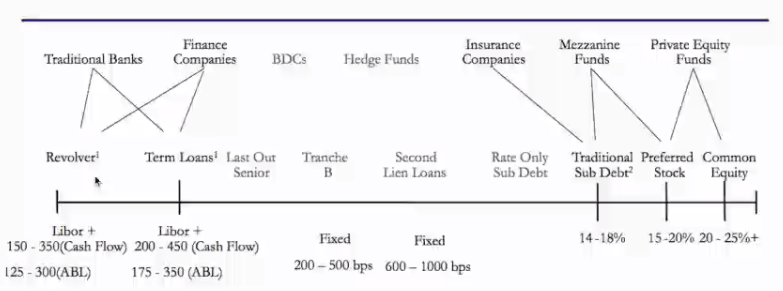

Management should consider that it has alternatives when it comes to debt sourcing: asset-based loans (ABL - as we discussed in the previous post), revolving credit lines, term debt, non-amortizing bonds, and more. We will discuss the three most common one in this post:

1. Revolver / line of credit

This bank-provided credit facility is typically used to finance working capital due to its short duration (1 year) and low cost. If there is enough surplus available, the remainder can be used to finance an M&A transaction. We will review how we can determine the availability of this capital through an ABL analysis several posts from now.

2. Term Loan

As we discussed in the previous post, this amortizable facility usually has a 5-year loan period, which can be used as an additional funding to an M&A program. Its availability is typically determined by EBITDA leverage metrics and enterprise value of the company.

3. Sub-debt (aka mezzanine or high yield debt)

This type of debt is usually used to finance transactions (and not working capital or capex). Its non-amortizing, higher-coupon debt structure drives companies to refinance this type of debt every 4-5 years as the companies pay down debt and other less expensive capital source become available.

* Courtesy of Professor Tom Harvey, Pennsylvania State University, 2017

Each form of debt typically has a coupon or interest rate, restricting covenants, and payment terms. While a thorough review of each of these elements is beyond the scope of this post, a snapshot of them is listed below:

* Courtesy of Professor Tom Harvey, Pennsylvania State University, 2017

In regards to establishing an acquisition purse / war chest, it is important to recognize that every company is different. There is no one-size-fits-all formula to this exercise. Even companies in the same sector will have different levels of debt and acquisition purse size. This variety is caused by the different specificities and characteristics of companies (industry, business model, maturity, size, etc.) as well as current management’s comfort with higher debt levels and associated risks. Key determinants include:

Cash flow size and stability: this is the most determinant, as it is the primary means of paying back the loan over a defined time period.

Enterprise value: debt lenders are usually only willing to lend up to ⅔ of company’s enterprise value.

Asset values: debt lenders focus on certain assets that can be liquidated if the company can’t pay back its loan from cash flows. We will delve deeper into asset-based-loan in a future post.

Liquidation value

Equity value

With all of these determinants, the larger the value or size, the better. With cash flow, the more stable the cash flow, the better. Combined they impact borrowing ability and the size of the M&A purse / war chest. Borrowing at low levels mean inexpensive debt capital that protects the debt lenders. As the company borrow more, the cost of debt increases and the lenders appetites for the company’s risk decline - making room for other debt lenders to provide capital at higher costs.

To showcase how we can size an acquisition purse / war chest, we use the following attached file:

In this file, we make several assumptions to simplify the process:

The acquisition will be made only with debt (no equity capital)

The target’s EBITDA margin is 10%

The acquisition multiples are 7x and 8x EBITDA

The acquirer has a company policy of no more than 3x EBITDA for senior debt and no more than 4x EBITDA for total debt

By trying several different amounts for Acquisition Amount (cell G4 in the tab labeled “Debt Capacity Model”), we can determine the maximum amount of senior and sub debts that an acquirer can carry in its acquisition purse / war chest without raising further equity capital. In our example above, the maximum purse size is $90MM.

It is important to remember that the maximum purse size calculation doesn’t mean that the acquirer should allocate that much for M&A, rather it should serve as the ceiling for the war chest. Internal discussions on the management’s considerations we discussed earlier should take place to determine the proper allocation of the purse; keeping in mind enough buffer for unexpected financial shocks to the business. It is recommended that this sizing exercise be taken up regularly (yearly and/or after each large acquisition) to make sure that the acquirer is not stressing under too much debt obligations. Such instances may lead to M&A failures: the need for additional equity raise, ownership dilution, value destruction, illiquid finances, distressed company, even bankruptcy. The 1986 Revco Drug Stores transaction is a colossal example of high debt causing a large company collapse within 19 months post-transaction. It was so bad the analyst community put the company’s survival probability to be 5-30% before the transaction. Yet, management surged ahead.

In conclusion, a good M&A program takes into account how it should be financed. There are multiple considerations that management should take into account when determining the purse / war chest size for an M&A program. Further, there are different alternatives for debt. There are exercises one can undertake to determine the optimal size of the purse / war chest. These are exercises that should be undertaken regularly to make sure M&A activities don’t pose a negative impact on acquirers’ liquidity. In the next post, we will discuss how lenders view a company prior to lending funds and how these parties behave when a borrower is illiquid or in distress.