M&A Blog #01 – definitions, myths, and types

You’ve seen the headlines many times: Sony Acquired Columbia Pictures, Volvo’s Merger with Renault, Quaker Oats Acquired Snapple, AOL Merging with Time Warner, and more. These are the attention-grabbing headlines that business literature such as the Wall Street Journal, Financial Times, and Harvard Business Review discuss extensively. In the next two months, we will discuss M&A in much greater details: reasons, considerations, stages, outcomes tracking and measurements. A special thank you to Professor Thomas Harvey of Penn State University; who clarified many of my M&A misconceptions from working in the profession myself and who recommended “Deals from Hell” by Robert Brunner – a must read for any serious M&A enthusiast. We will start our M&A discussion with this blog post where we will go through what is M&A (mergers & acquisitions), the myths and perceptions related to it, and the types of M&A transactions out there.

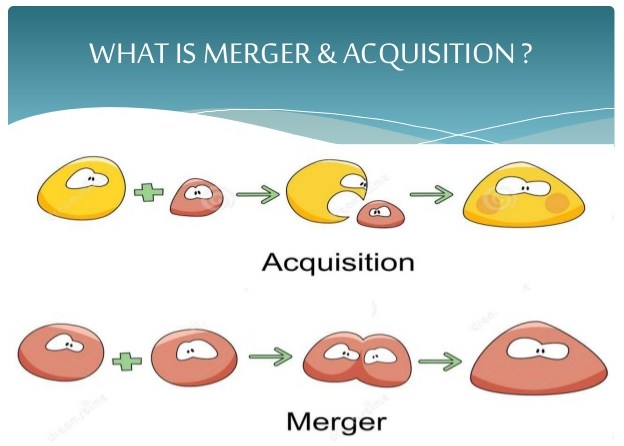

M&A is a business occurrence when a company merges with or acquires another company. It is one of the options that a company has at its disposal to grow, compete, hedge business operational risks, and satisfy shareholders. A merger happens when two companies of roughly equal size join forces together. An acquisition happens when a company acquires another company (the target) and the target ceased to exist post-acquisition (it has been “swallowed” by the acquirer). Mergers of equals are rare these days.

85% of M&A transactions failed to meet their objectives, per KPMG 2015. There are many reasons for M&A success and failures (we will cover them in the next blog post). For now, let’s go through some of the myths and perceptions about M&A:

M&A is a separate business activity than normal operation:

M&A should be viewed as a part of corporate strategy and should be considered within normal business planning process – just like any other corporate investment activity. M&A failures are often a function of disconnects between long-term company strategies and large acquisitions.

The larger, the better:

Most business literature focuses on large public transactions involving billion of dollars. The saying of “the larger they are, the harder they fall” is certainly true in M&A. Large transactions carry with them complexities and execution risks that require major strengths and competencies on both sides (acquirer and target) to complete. However, most US M&A transactions are small and involve private companies – 95% of transactions are less than $1 billion in value and 60% are less than $250 million.

M&A doesn’t pay:

Many studies from Bain & Company, McKinsey & Company, Booz Allen Hamilton indicate that shareholder returns for acquirers are either zero or negative. Meaning, the odds are against the acquirer. This is an element that corporate leaders should carefully contemplate when looking for further revenue and cash flow growth. In the face of shareholders’ demand for further growth, M&A doesn’t always add to shareholder value. When in doubt, corporate leaders should consider shares buybacks or dividend issuances (one time liquidating or ongoing) as an alternative to M&A. Like M&A, these two tools should be carefully designed to meet shareholders’ expectations. We will discuss them in future posts.

M&A reduces competition and is bad for consumers:

Some M&A transactions determine the life and death of the two companies involved (think Sirius XM). Some M&A transactions yield economies of scale and scope with cost savings that were then passed on to the consumers (think retail banking and utilities M&A deals). Some M&A transactions save failing businesses that would have harmed consumers (think JP Morgan’s acquisition of Bear Stearns, Bank of America’s of Merrill Lynch, and more in the 2008 Great Recession). While it is true that M&A can reduce some competition and harm consumers, not all are bad from the get go.

You may have noticed that some acquirers bought targets who were competitors or business partners. In fact, there are three types of M&A activity:

1. Horizontal: involve two companies in similar business

Examples would be Coca Cola acquiring Tata Tea or Volvo merging with Renault. Horizontal deals carry out operational and distribution synergies while expanding economies of scale and market power. This is the most popular type of M&A activity with close to 80% of deals falling under this category. The risks of such deals typically include the massive post-acquisition integration and execution risks. Moreover, sorting through and cutting overlapping areas and responsibilities mean hard choices and potential organizational stress.

2. Vertical: involve two companies at different points on the value chain

Examples would be Disney acquiring Cap Cities or Coca Cola acquiring one its bottlers. Vertical deals allow companies to gain additional control over value creation and customer relationships while capturing discrete capabilities and scarce supplies. The risks of such deals typically include channel conflict, the limited amount of synergies, the loss of sourcing and selling flexibility, and the complexity of managing a different business (management skills in one business doesn’t always translate well to another business).

3. Conglomerate: involve unrelated companies

Examples would be General Electric and Cooper Industries. True conglomerates are less common these days. Conglomerate deals enables company to identify undervalued companies and invest at favorable entry points, apply best practices across multiple businesses, and reduce cash flow cyclicality and capital costs. The risks of such deals are limited synergies, the overwhelming cross-pollination of best practices, and large costs (shareholders can gain diversification benefits by hedging stocks and bonds - more efficiently than companies combining two businesses or paying control premiums).

In conclusion, M&A happens often as a tool of corporate growth. A merger is different than an acquisition and more rare these days. There are a number of M&A myths and perceptions, some are just myths and some have truths to them. There are three different types of M&A activities, each with its goals, benefits, and risks. Corporate leaders have much to consider when considering M&A as a tool to grow, compete, hedge operational risks, and satisfy shareholders.