Financial Statement Analysis Blog #6 – capital structure analysis

“I love the ability to create a capital structure that is appropriate for a company, no matter what field it happens to be in.”

How a company structure its capital is very important to an investor (or acquirer). Capital structure affects bottom line profitability in the sense that leverage (debt) carries interest expense that gets paid out from operating profit. Because of this reason, we should review the company’s efficiency in using its capital, which we can do through capital structure analysis described in the following paragraphs.

From the leverage ratios that we reviewed in our DuPont analysis, we can start to examine the composition of liabilities. Followed by looking for any significant changes from a trend analysis of long- and short-term debts, and relating them to the trends seen in leverage ratios. We should then calculate the following efficiency ratios:

Current ratio

Quick ratio

Days sales outstanding

Days on hand of inventory

Number of days payables

Cash conversion cycle

And conclude the analysis with comments on the trends of the efficiency ratios.

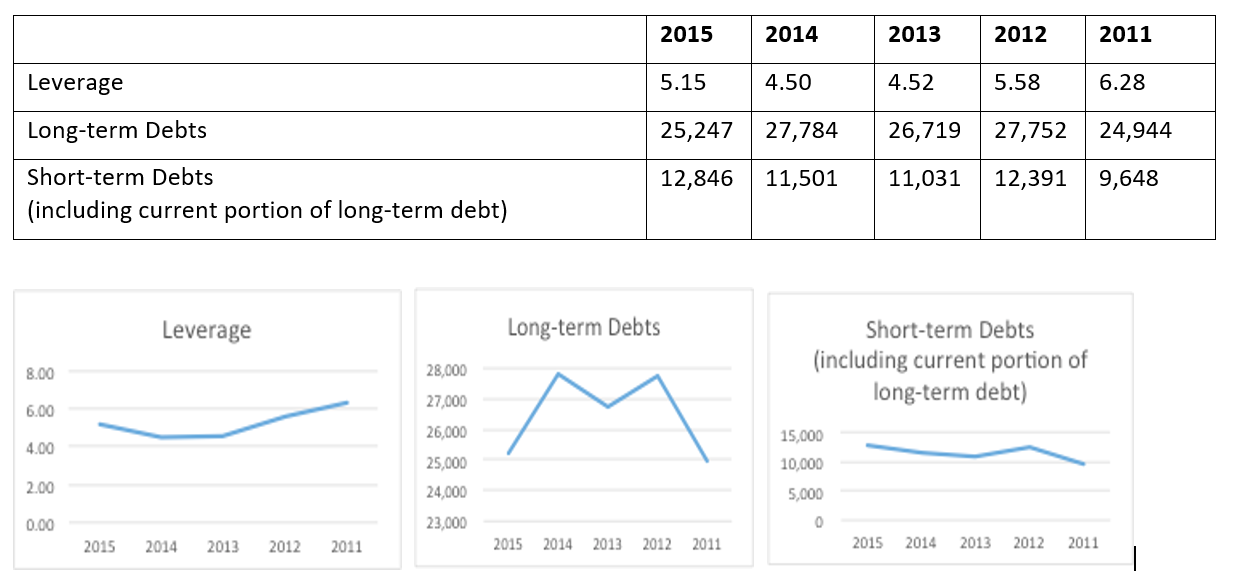

When I looked at the composition of liabilities of our example company Caterpillar (CAT), I noticed that the trend analyses of long-term debts revealed significant fluctuations. Short-term debts remained relatively flat, which yielded a net effect of less fluctuation on the leverage ratio:

The DuPont analysis indicated that the company had re-leveraged in 2015 - after a flat period that was preceded by a period of de-leveraging. As the leverage ratio alone does not show much about the nature of leverage, long-term capital structure is a better indicator of the company's long-term capital strategy. Long-term debts seem to vary year to year in the last 5-year period, while short-term debts consistently increased in the same period. While the period of 2011-2014 sees a parallel increase / decrease in both types of debt; in 2015, the company increased its short-term debt and decreased its long-term debt. The net result is an increase in the leverage ratio.

As a percent of total long-term capital, CAT has held their long-term debt level steady over the last 5 years. The period of 2011 to 2013 saw an increasing trend of building up total equity, which indicated a move towards a less financially risky capital base. The period of 2013 to 2015 saw the reverse, with the net effect of total equity still higher than the 2011 level (by 4%). The volatility of the company's total equity level may indicate a period of high uncertainty for CAT.

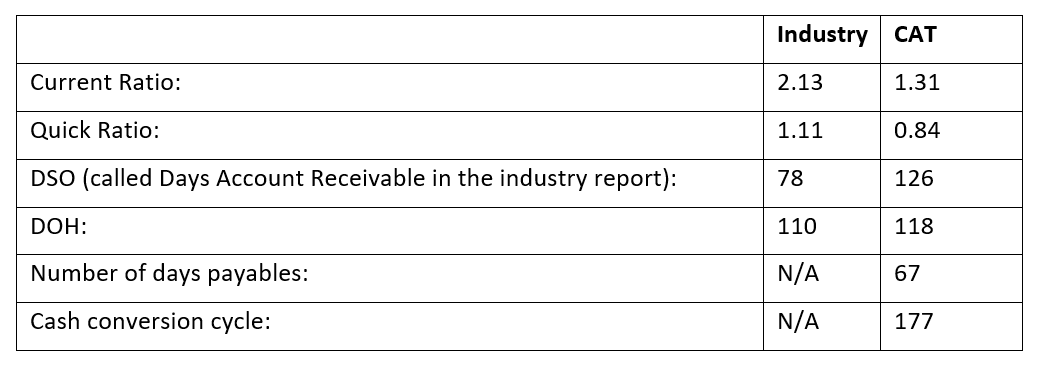

Looking at CAT’s efficiency ratios:

In comparison with industry* data from Hoovers:

* Industry is defined as the Construction Machinery Manufacturing Industry. NAICS: 33312. Data Period: 2015. Company size benchmark: Large (over $50M revenue companies).

My comments on the result of the trend analyses of the efficiency ratios are as follow:

· CAT's current ratio has deteriorated over the past 4-years period. The quick ratio has improved over the same period (supported by the knowledge that the company has increase its cash on hand). CAT is still able to meet its short-term obligations. However, in both ratios, it fell behind the industry average pretty heavily. CAT should look into improving its liquidity.

· CAT 's DSO indicates a deteriorating ability to collect cash from its customers in the past 4-years period. It signals efficiency problems with the company's credit and collections procedures. Compared to the industry, CAT 's DSO is 60% longer - indicating a lot of rooms to tighten.

· CAT 's DOH indicates a deteriorating inventory management. The company has been holding onto inventory longer and longer in the past 4-years period. Compared to industry, they hold onto its inventory 7% longer. CAT's declining sales and revenue might impact its DOH. Further investigation is needed to check if this heightened DOH is caused by technological obsolescence (compared to its competitors).

· CAT 's number of days payables has been increasing in the past 4-years period, which indicates that the company is taking longer and longer to pay its suppliers. Given that the Current Ratio indicates that CAT is still able to meet its short-term obligation, we can conclude that they are taking advantage of lenient supplier credit and collection policies. Unfortunately, no industry data can be found on this metric (for comparison purpose).

· CAT 's cash conversion cycle has been increasing in the past 4-years period, which indicate that CAT's funds are tied up in working capital longer and longer. During this period of time, it would have needed to finance its investment in operations through other sources (i.e.: debt / equity). Unfortunately, no industry data can be found on this metric (for comparison purpose).

An even deeper look into total assets revealed the following:

The percentage of total assets that is fueled by long-term debts seems to have been increasing, especially in the period of 2011 to 2014. Although the number decreased in 2015, this trend is troubling. Especially when compared with receivables, inventory, and payables (all are declining). In a healthy company, an investor would like to see more assets backed by equity. When a company’s assets is mostly backed by debt, in the event of a bankruptcy, debtholders will have a senior position to equity that allows them to recoup their losses before equity (share) holders who are partaking in the company’s long term growth position do.

The Excel file that calculates the above figures and drives the conclusion is embedded.