Financial Statement Analysis Blog #7 – segment & capital allocation analyses

“An investor without investment objectives is like a traveler without a destination.”

An investor looking to invest in a company should look at the company’s management team to make sure that they are performing their fiduciary duty of protecting and increasing shareholders’ value. The same goes for an acquirer looking at a target company for acquisition. But how do you know that management had done the right thing, investing in the right opportunities, and taking educated risks?

A good way to assess management’s aptitude in investing in the right opportunities, especially when it comes to a large company with multiple business segments, is to perform the segment and capital allocation analyses. This blog post focuses on finding profitable business segments among the many segments that a large company may have, and doubling down on increasing profitability from those segments. The analyses proceed as follow:

Start with finding reportable segments of the company, conducting a trend analysis on them, and reviewing the performance metrics of the segments.

Calculate the ratio of proportion of capital expenditure (CE) to proportion of total asset (TA) for each segment by:

Dividing the segmental CE to total CE – to get proportion of capital expenditure

Dividing segmental TA to total TA – to get proportion of total assets

Dividing 1 and 2 to get the ratio of proportion of CE to TA.

Keeping in mind the performance metrics from earlier, we review the ratio of CE to TA for each segment and compare the ratio for segments to answer the following questions:

Does higher capital investment bring higher profitability?

Did management invest its capital in the more profitable segment (investment efficiency)?

If the answers are no, what should management do policy-wise to correct the course?

Conclude with a trend analysis of asset management efficiency of the business operations by calculated a ratio of sales to total assets.

A trend analysis on the performance metrics of our example company Caterpillar’s (CAT’s) segments along with my comments are outlined in the following paragraphs.

CAT's largest sales segments are North America and Latin America and CPF at over 43% and 20% respectively in 2015.

It is worth noting that CAT's sales in North America, while still growing, is growing at a much lesser rate than the previous year. Consequently, EBIT also grew at a lesser rate than previous year. This phenomenon can be caused by the external conditions (maturing market, economic condition, etc.) or by internal decision (management lessening capital investment in this segment).

It is worth noting that CAT's sales and EBIT in Latin America and CPF declined in 2015, right after a robust year of growth in 2014. As with North America, the cause can be external or internal.

Interestingly, while the rest of the industry (per Hoovers), are betting on Asia Pacific for growth, CAT are having difficulties growing in that region. While the segment is still profitable, sales and EBIT have declined in the past 2 years with 2015's decline rate being much worse than 2014's. Like the other two geographical segments, the cause can be external or internal.

In North America, CAT has a lot of assets and capex (capital expenditures) tied up in the region. These investments are disproportionate to the profitability of the region. For example, in the past 2 years, CAT consistently has twice the level of capex to EBIT margins. This allocation is not an effective use of capex nor assets.

In Latin America and CPF, while CAT 's allocation of assets to the region is okay, it can use some improvements. Except for 2014, CAT allocated higher percentage of total assets to the region than what the region brings in on profit. Fortunately, the company is allocating less and less capex to the region in the past 3 years. CAT should continue to reduce capex allocation until the region brings in same-or-better profit level as allocation of total assets to that region.

The interesting geographical segments that CAT should focus on are Europe and Asia/Pacific. In Europe, CAT is receiving roughly 31 to 34% profit at an investment of 12 to 14% of assets and 8 to 13% of capex. This allocation is a very effective use of assets and capex.

In Asia Pacific, CAT is receiving 23 to 39% profit at an investment of 12 to 16% of assets and 2 to 3% of capex. This allocation too is a very effective use of assets and capex. No wonder this is where the rest of the industry is heading.

CAT should look into shifting the allocation of assets and capex to Asia Pacific and Europe.

When I dig deeper into investment efficiency ratios:

These investment efficiency ratios further show that CAT has not been investing in its most efficient segments. Asia Pacific and Europe are where CAT’s investment are most efficient and should be doubled down.

Even Latin America and CPF as well as Mining have been more investment-effective segments than North America. Management should really re-consider their investment in the North American region.

As we can see:

· Europe: CAT 's most profitable segment currently. The company's investment into region varies in the past 3 years, decreasing from 2013 to 2014 and the reverse from 2014 to 2015. Comparing that trend to the smooth increasing trend of North America ratios. A trend of below 1 ratio threatens a segment to become less significant over time. A tragedy for CAT 's Europe segment if realized.

· North America: CAT has been growing the North America segment aggressively (in growth mode) even though it is not CAT 's most profitable segment. As we have concluded before, CAT has been investing disproportionately in the segment, with questionable ROI. As the 2nd highest EBIT margin segment, largest assets and capex allocation, and disproportionate capex-asset-to EBIT; North America seems like a high-maintenance operation. If CAT continues to allocate capital towards this segment, the overall returns might be impacted negatively and CAT might become more dependent on its investment to sustain performance in North America.

· Asia Pacific: CAT should also look into growing the Asia/Pacific segment more. It is currently the 2nd most profitable segment for the company after Europe, and as we concluded earlier, it took less investment to yield the same amount of profitability in Asia Pacific than in Europe. Meaning, at the same level of investment, Asia Pacific's profitability would have surpassed that of Europe's. Fortunately, CAT has been increasing investment in the region.

· Latin America and CPF: the amount of total assets that CAT has been allocating to this segment has been too high for the amount of ROI (profit) that it is bringing in. Fortunately the company seems to realize it and has been reducing its capex every year in the past three years. While this segment can still be a profitable one for CAT, it is definitely not one that holds the most potential and ROI for the company.

· Mining: CAT invested aggressively on this segment in 2013 and 2014 as the above 1 ratios indicate. However, as the least profitable of all the segments, this segment shouldn't be the recipient such capex allocation. The company seems to realize it, and have reduced its capex allocation over time to yield a smaller and smaller asset base for the segment in the past 3 years.

As we see above, the higher capital investment does not always bring higher profitability. For CAT, North America, Mining, and Latin America and CPF are good examples. CAT did not invest its capital in the more profitable segment. To increase its investment efficiency, CAT should truly look into shifting more of North America investment into Asia Pacific and Europe. Both are currently a small part of CAT 's asset base, revenues, and EBIT, but have the potentials to be so much more.

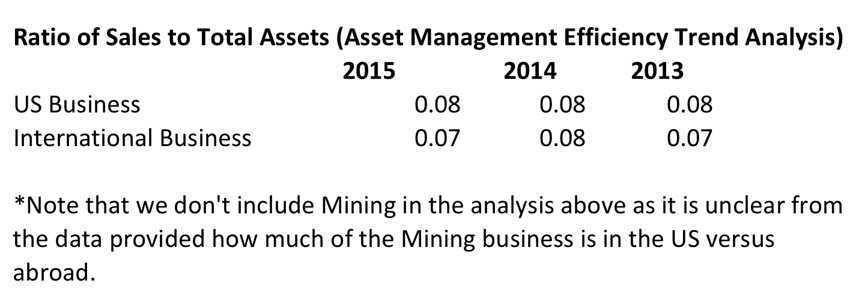

As we can see:

· The trend analysis of asset management efficiency for the US business operations group shows a consistent 0.08 ratio of sales to total assets.

· The trend analysis of asset management efficiency for the International business operations group shows a relatively consistent 0.07 ratio of sales to total assets.

· These numbers mean that, for every $1 of total assets held during the 3-years period, CAT is generating $0.08 and $0.07 sales for the US and International businesses respectively. To gauge if these numbers are good or bad, there is a need for corresponding industry's numbers. Unfortunately, I was not able to find these industry's figures after searching Hoovers, Yahoo Finance, and several other reports sources.

The Excel file that calculates the above figures and drives the conclusion is embedded.