M&A Blog #17 – valuation (Comparable Company)

When one is buying or selling a house, condo, or other real estate property; often times, one would like to know the going price of similar nearby properties. The same concept applies to Comparable Company and Precedent Transaction: what price tags are other buyers put on similar assets? As I mentioned in my valuation preparation post, Comparable Company is a valuation method that uses metrics of other similar businesses (same industry, size, geography, valuation multiples, etc.) to find the value estimate of a potential investment. In this post, we will discuss the mechanics of Comparable Company step by step, starting from the point where all the needed tools and data for such analysis as outlined here have been gathered.

The major steps of Comparable Company are:

Deriving the appropriate market multiples (or range of multiples).

Building the proforma income statement, proforma balance sheet, and Free Cash Flow to Firm (FCFF).

Calculating cost of debt, cost of equity, and weighted average cost of capital (WACC).

Calculating the Terminal Value and the Value of Operation.

Determining the current value of non-operating assets (cash) and the Enterprise Value.

Determining the year-by-year future non-equity claims from the latest 10-K, especially those that will occur during the forecast horizon, and their combined present value.

Calculating the Equity Value and the per-share Equity Value - this number would serve as the base case share price valuation.

Performing sensitivity / scenario analysis using Monte Carlo analysis.

We will delve deeper into each steps above in the following paragraphs of this post. It is worth noting that each step can justifiably warrant an entire post in itself. For the purposes of this post though, we will keep matters concise by discussing only the most practical and commonly accepted aspects of each step.

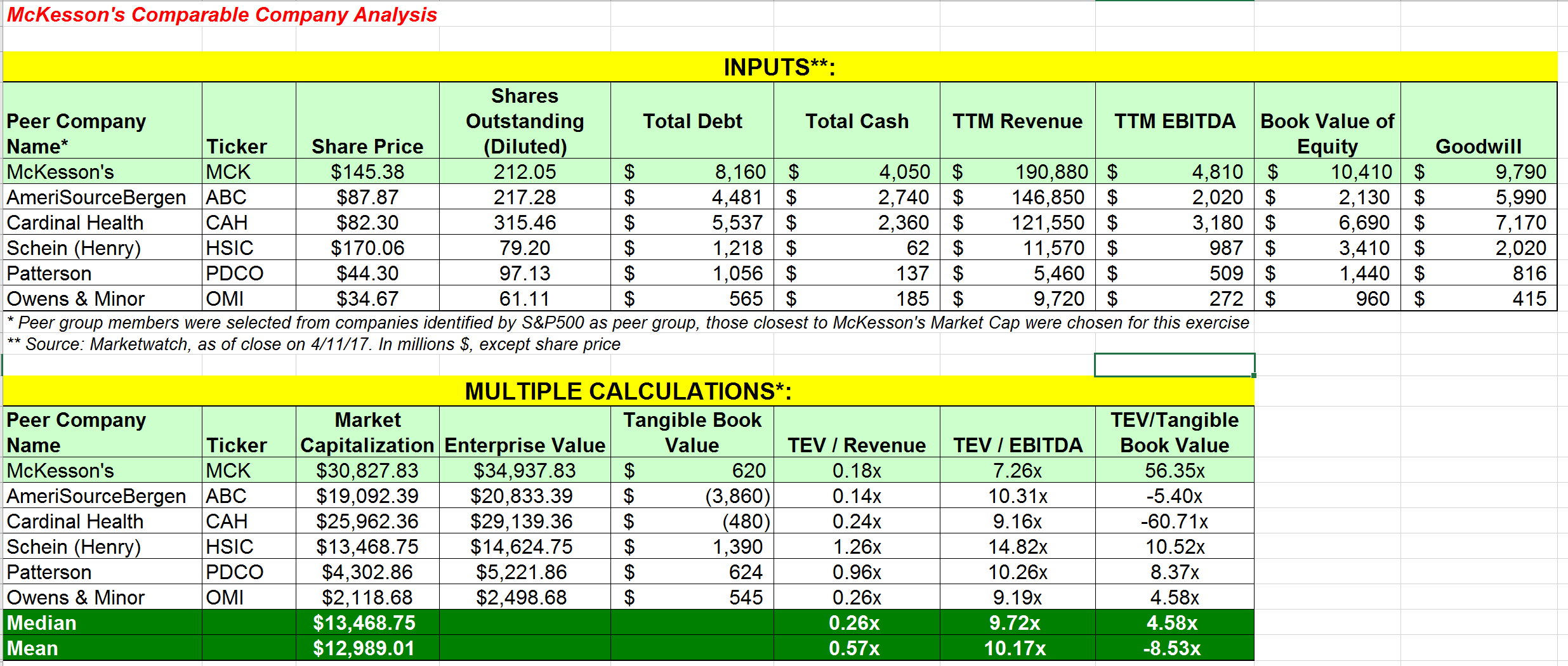

The 1st step in Comparable Company is to derive the appropriate market multiples (or range of multiples) for the valuation. While different valuation professionals differ on which multiples to use based on the target’s industry, and so on; a few multiples have became analysts favorites: TEV/Revenue, TEV/EBITDA, and TEV/Tangible Book Value. TEV stands for Total Enterprise Value. Once we decided on the multiples used, we then proceeded with setting up the appropriate peer group and gathering the relevant financial data of the peer group companies. Further guidance on how to do so were outlined here. The multiples calculation then proceeded as follow:

Market Capitalization = Share Price * Fully-diluted Shares Outstanding.

Enterprise Value = Market Capitalization + Total Debt - Total Cash.

Tangible Book Value = Book Value of Equity - Goodwill.

TEV/Revenue Multiple = Enterprise Value / LTM Revenue.

TEV/EBITDA Multiple = Enterprise Value / LTM EBITDA.

TEV/Tangible Book Value Multiple = Enterprise Value / Tangible Book Value.

Once the multiples are calculated, we derive the mean and median values of each multiples for the peer group companies. If the multiples are close to each other, it is reasonable to choose the mean values as the multiples. Otherwise (if the multiples are spread apart), it is reasonable to choose the median values as the multiples. We can also split the difference and use a range of multiples.

The 2nd and 3rd steps in Comparable Company call for the building of proforma income statement, proforma balance sheet, and FCFF as well as for the calculation of cost of debt, cost of equity, and WACC. As we have previously covered what are needed to complete these steps in our DCF discussion, I would refer to those steps (1 through 7) here. They are basically the same for this exercise.

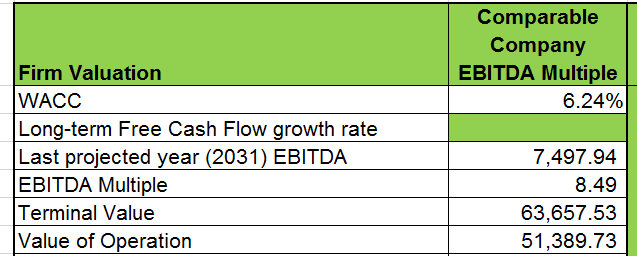

The next (4th) step in Comparable Company is to calculate the Terminal Value and Value of Operation. The Terminal Value is calculated differently here than in the DCF method, basically:

Terminal Value = the chosen multiple (or range of multiples) * the last proforma year’s EBITDA from the proforma income statement previously calculated.

The Value of Operation = the Net Present Value of the FCFF with the last year’s FCFF including the Terminal Value * (1 + WACC) ^ (½).

The 5th through the 8th (final) steps in Comparable Company call for the determination of the current value of non-operating assets (cash), the Enterprise Value, the non-equity claims, Equity Value, and the Per-share Equity Value; as well the completion of a sensitivity / scenario analysis using Monte Carlo simulation. As we have previously covered what are needed to complete these steps in our DCF discussion, I would refer to those steps (9 through 12) here. They are basically the same for this exercise.

A sample file for a Comparable Company analysis on the company McKesson can be accessed here; it is recommended to open @RISK first before opening this file due to the Monte Carlo simulation embedded in this file (the file will open with errors without @RISK). To download a free trial version of @RISK, click here.

As we can tell from the steps laid out thus far, Comparable Company has advantages and disadvantages. The advantages include the ability to re-purpose proforma statements and FCFF that have already been built for DCF (hence DCF and Comparable Company are often paired together), the similarities of how per-share equity value is determined from the Value of Operation onward, the ability to incorporate the “market’s view” (the valuation of peer companies), and the ease / simplicity of the exercise and usage. Comparable Company’s disadvantages include the difficulty of finding “pure play” peer group companies (of similar size, relative financial performance, relative growth prospects, capital structure, end markets, market geography, etc.). Not every company has a publicly traded peer group comparables (private company or wholly-owned subsidiary peers might exist), some companies might be the only one of their kinds. Thinly-traded or volatile companies (such as startups) might present additional challenges.

So, to re-cap, we have discussed the development of a Comparable Company model and its supporting elements, along with its strengths and weaknesses. It is worth reiterating that while the broad steps are well established, different valuation analysts have different twists when it comes to calculating each supporting element. Preferences, stages of maturity of the target, and the usage of the valuation results highly influence the result. Given its advantages and disadvantages, Comparable Company is best used in conjunction with other valuation methods (it is often paired with DCF). It is only then that the closest-to-correct value of the target can be deduced via comparison. In the next post, we will discuss another valuation method, Precedent Transaction.