M&A Blog #24 - Merger Relative Valuation

It has been roughly three years since my last blog post at the completion of my fellowship. Time certainly did fly by when one was having fun. Many things have happened since then, including having 2 Corporate Development & Strategy jobs with a large, domestic conglomerate in Jacksonville, Florida and a smaller international technology company in Seattle, Washington. I learned a few new things in these 2 roles, including how to evaluate a merger opportunity and present it to a corporation’s Board of Directors (BoD). To pick up where we last left off with valuation, I will cover the topic of a Merger Relative Valuation in this blog post and move on to other non-valuation topics from here. A template presentation deck - based on a real merger case - will be presented here to showcase concepts and thought processes.

A good BoD would be very interested in what the newly combined company - let’s call this NewCo - would look like post-merger. Specifically, they should be interested in what each party brings to the transaction, each party’s equity share in NewCo, and the issues / risks associated with the transaction. As a Corporate Development & Strategy personnel, my task was to answer these questions.

I typically started my due diligence with a high level view of the target company my employer was considering to merge with. After all, one doesn’t marry another party without first getting to know the other party. In merger cases, we should look into the other party’s business, their financial standing, and what synergies can be had to make the marriage more than 1+1=2. The mindset behind the transaction should be how can we make 1+1=3 or better.

In laying down the facts about the target partner for the BoD’s consumption, I typically started with a high-level overview of the company:

If the company is a startup, growing, or mature company - different lenses should be used in evaluating each type.

What product and/or services the target sells.

A link to the target’s website for BoD members who want to know more.

Any notable B2B and/or B2C customer relationships - this will also give the BoD a hint of the target’s business model.

Any notable competitor of the target.

Differentiating factors that set the target a part from its competitors.

The headquarter location and the business laws / regulations the target is subject to.

The target’s known ownership structure.

Lastly, what is the target looking for from this merger.

Any parts that don’t fit that should be sold off after acquisition

I typically discussed the target’s financials next. The BoD did not need to know every detail (think the forest instead of the trees here). They needed to know exceptions that diverge from the norms of businesses of the same type. This is where a merger of 2 equals in the same business can truly highlight issues and risks: a target’s competitor has the domain knowledge to spot irregularities.

A discussion of the target’s financials typically starts with the P/L or Income Statement, followed by the Balance Sheet, and then the Cash Flow Statement. In discussing the P/L, I typically comment on:

Revenue - by lines of business, whether they appear to be gross or net, and if there is any meaningful customer concentration. Bonus hint: customers with large accounts (typically greater than 5% of Revenue) with the target should be first in line for retention in the integration plan and execution. Additional considerations are warranted if these customers are slow-pay, lower-margin-than-usual, or another type of less-than-optimal customers.

COGS - whether it is roughly in line with what is to be expected, any exclusion that warrants a reversal, and any reclassifications to normalize COGS.

SG&A or OPEX - target’s spend to acquire and retain customers, any treatment of the OPEX that warrants a reversal to normalize OPEX.

A note on financial reversals and reclassifications: this is not an activity that a CorpDev person should undertake on his/her own, no matter how many years of experience the person has. This is an activity where the CFO, Controller, or someone from their offices who knows the intimate details of the company’s financial structure should be solicited. Not only will it increase accuracy, it will also make getting buy-ins and sign-offs easier (a positive side effect to cross-functional collaborations).

With respect to the Balance Sheet, one can typically assume that the BoD reviewing the Balance Sheet has the experience of having reviewed a number of Balance Sheets before. Given this assumptions, I typically comment on less-common Balance Sheet findings such as:

Regular cash infusions from the shareholder to prop up a target company.

Cash balance on the books without Restricted Cash.

Working Capital deficit.

Negative equity balance.

Adjustments (corrections, additions, and removals) of line items that I had to apply to make the target’s Balance Sheet comparable to my employer’s.

As with the P/L reversals and reclassifications: any Balance Sheet adjustment activities should be undertaken in collaboration with the CFO’s or the Controller’s office.

With respect to Cash Flow Statement, similar to Balance Sheet’s assumption, one can typically just comment on less-common findings such as:

A high dependency on cash infusions from the shareholders - this is typically an indicator of a startup or a failing company, which is why it is important to know where the company is in its growth. A mature failing company is a money pit and requires extra consideration in M&A.

Any debt drawdown and paydown schedule.

Other causes of financial fluctuations that can be discerned through a review of the financials.

For the accounting professionals out there, earnings manipulation is a matter of concern. Companies big and small are subject to earnings manipulation, so it is good to have an early indicator (a rule of thumb, so to speak) of it. After all, the ability to hire expensive forensic accounting experts to sniff out earnings manipulators is not one that all companies can afford, nor it is appropriate for early stages of the transaction. To lay this concern to rest, I typically resort to the Beneish and Piotrosky accounting tests. Both tests detect the likelihood of earnings manipulation presence in financial statements through metric evaluations. If a company’s total scores from these metric evaluations are off the specific “safe zone” thresholds, then it is very likely that the company is an earnings manipulator and we need to bring out the heavy artilleries (forensic accountants).

A note on the accounting tests: it is good to also test one’s company’s own financials. The BoD is very likely to want the comparison. This is also an activity that should be undertaken in conversations with the CFO and the Controller (the parties that are likely to get questioned by the BoD should any earnings manipulation get detected from one’s own financials).

To wrap-up the discussion around the target’s financial review, I typically end the section with a summary of the target’s financials PROs and CONs:

Revenue growth rates: acceleration and deceleration by lines of business.

Gross Margin: compare to expectation.

OPEX growth rate: compared to that of revenue’s.

EBITDA: positive or negative, and in the case of the latter, the projected timeframe to profitability.

Accrued liabilities: balance and trajectory.

Accrued expenses: balance and explanation of drivers.

Shareholder equity: positive or negative.

Cash consumption: current and forecast, along with the degree of dependency on financing.

Unusual OPEX or CAPEX spend: in comparison to the industry or the competitors.

Other issues and risks that impact profitability or break-evenness.

Indicators of earnings manipulation.

After a deep dive into the target’s company, the discussion should now shift gear into what a possible good transaction looks like. This part of the presentation typically starts with the strategic rationale (transaction logic). In addition to the greater combined revenue, we should also explore any cost, revenue, market / branding, and other strategic synergies. What are all the factors that will make this marriage of two companies more than 1+1=2?

Our exploration of synergies should start with a combined and normalized P/L. No two companies are perfectly alike, even if they have similar business models and operate in the same industry. Some adjustments would be needed to make for a like-for-like combination. It is very important for a Corporate Development professional to work with his/her CFO and Controller at this stage. The goal is to produce accurate adjusted combined financials that will be the base for the cost and revenue synergies. Getting this part wrong will yield incorrect synergies that will under/overstate the entire valuation.

Structurally, here is one good way to proceed with the synergy discussion:

How would the combined company NewCo’s P/L look like on a like-for-like comparison basis - basically, the old 1+1=2.

How would NewCo’s P/L look like if the cost synergies were added - basically 1+1=2.5.

And lastly, how would NewCo’s P/L look like if the revenue synergies were added - basically 1+1=3 or 3.5.

An exploration of the cost synergies should firmly state the assumptions the cost synergies are based on. These assumptions can be, among others:

Technology streamlining.

Staffing streamlining.

Operations streamlining.

Facilities streamlining.

Third-party services (consultant, subscription, supplier,etc.) streamlining.

Other duplicative costs that both companies have in common

In discussing these cost assumptions, it might also be helpful to separate COGS from OPEX (SG&A) - specifically because in certain industries, like tech, COGS reduction, is valued higher than OPEX reduction. It might also be helpful to have a pre-synergy, synergy by each of the merging parties and combined, and post-synergy views displayed along with the combined EBITDA impact from the synergies. Having these components displayed as such allows the executive leadership team and the BoD to fine tune what the post-merger cost structure could look like.

In coming up with these cost synergies, it is highly critical that the Corporate Development person works with the heads of the Operations, Technology, Finance, HR, Marketing, HR, Legal, and Procurement (if exists) to identify overlapping costs between the two merging companies. As operations and technology costs tend to be the highest for most companies, the involvement of these two areas in the cross-functional due diligence phase is mandatory. Their absence could lead to a lack of staffing and supporting infrastructure needed to achieve the synergies targeted by the merger. This point is most visible when a pre- and post-merger headcount review is presented.

I typically end the evaluation of the cost synergies by stating their PROs and CONs, touching on subjects such as the overall estimate for the cost synergies and where it comes from, what does this number means to the combined annual COGS and OPEX, any less-than-positive impact to the liabilities on the balance sheet, the implications on time to execute and realization of the synergies, as well as any one-time restructuring costs that would be needed to realize the synergies (severances, technology projects to streamline the technology stacks, etc.).

After a deep dive into the cost synergies, the discussion should now shift gear into revenue synergies. Specifically, this part of the discussion should start with what are all the possible revenue growth strategies that the newly combined company NewCo can pursue. Some companies lean B2C or B2B depending on current business models, some choose to pursue a hybrid combination of both. Whichever it is, this part requires the mandatory participation of the Chief Marketing and Sales (sometimes known as Chief Revenue or Growth) Officer(s) - the party(ies) responsible for producing revenue for NewCo.

Next, the different growth strategies’ high-level assumptions should be laid out:

The explicit focus of each strategy.

Why is the strategy a good idea (what competitive advantage of NewCo is the strategy leveraging?).

What would it take to execute this strategy operationally.

What would it take to execute this strategy financially.

Having laid out the high-level assumptions, we can now go into detailed discussions on each strategy:

The thesis of each strategy (what do we expect from this approach?).

The detailed assumptions on the strategy’s ability to grow revenue (at what rate for each of the merging companies?) by lines of business.

The expected increase in operational activities of key lines of business’ drivers.

The expected decline of a specific line of business’ operational activities and corresponding revenue (if a particular strategy caused a shift in focus away from the specific line of business).

The assumptions on increase / decrease of COGS and OPEX (SG&A) spend to achieve the revenue synergies.

NewCo’s revenue growth over time - in both local currency and in % CAGR.

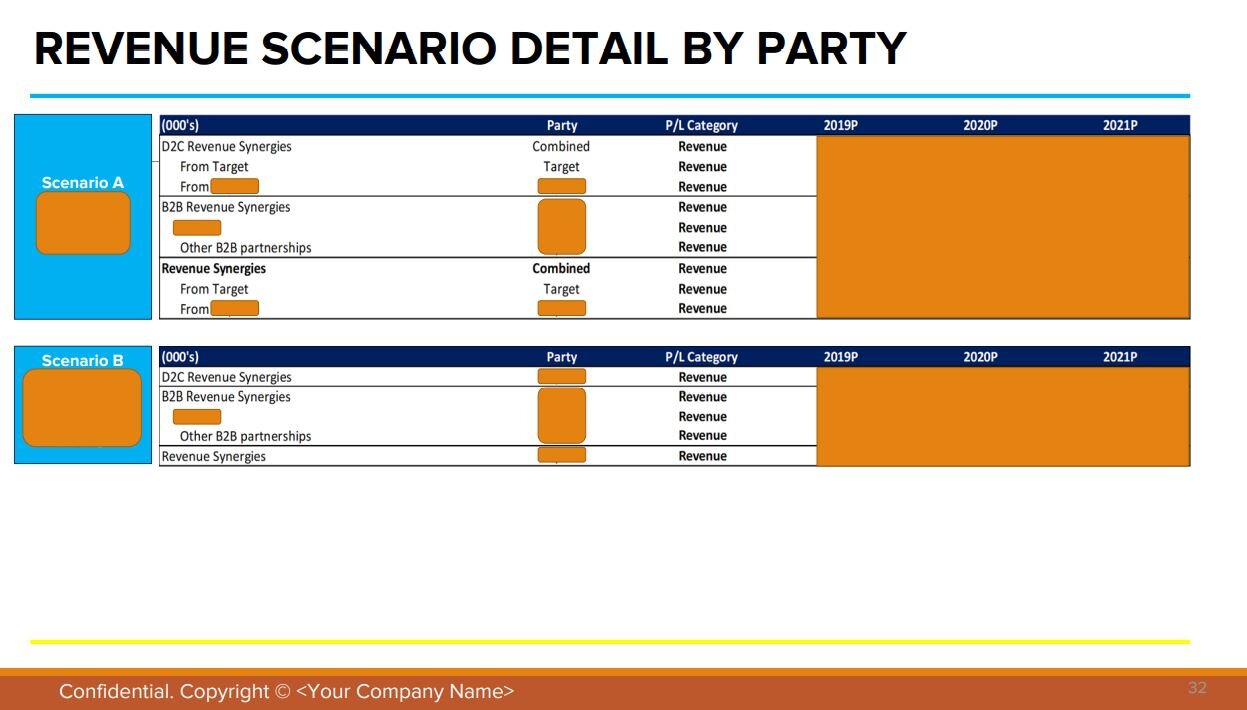

(Optionally) It might be good to reveal what each company brings to the combined revenue when presenting the main recommended revenue strategy at this stage.

NewCo’s EBITDA growth over time - in both local currency and in multiple.

(Optionally) The detailed revenue synergies, COGS and OPEX adjustments, net EBITDA impact, and post-revenue synergies impact to the P/L.

Once all of the revenue strategies have been discussed in details, it is worthwhile to remind the BoD of what each revenue strategy means in terms of Revenue and its growth (both in local currency and % CAGR), EBITDA and its growth (both in local currency and multiple), and most importantly - which revenue scenario these metrics favor. The inclusion of this reminder in the presentation makes it easier to orient members of the BoD onto the winning approach.

As a cautionary / risk mitigation effort, I typically include a discussion on revenue sensitivities: what would it mean if NewCo only achieves 75%, 50%, and 25% of the expected results? After all, one can (should) plan for the best and prepare for the worst. Hopefully, even in the case of 25% of expected results, the merger is still worth the consideration.

As with the stand-alone target financial review and the cost synergies discussions, I typically wrap up the evaluation of the revenue synergies by stating the PROs and CONs. Specifically, highlighting any strong underlying synergies shared between the two companies, where the synergies amounts come from, specific investment needed to support the synergies, revenue sensitivities analysis result, and positive or negative impact on short-term EBITDA.

At this point, the BoD would have had the opportunity to review the stand-alone target financial, the cost synergies, and the revenue synergies. We are now ready to pull everything together in the form of a relative valuation of NewCo 3-years out. Why 3-years out you may ask - well, years 1 and 2 post-merger are typically when the streamlining activities and the planning for cross-selling activities take place. Actual financial results usually lag these activities and only show in Year 3.

At this stage, it is helpful to layout what the plain vanilla combined and normalized P/L, what that P/L looks like if the cost synergies are overlaid in, and what that P/L looks like if the cost synergies and the revenue synergies (by scenario) are overlaid in. It is also helpful for decision-making to show what these revenue and EBITDA metrics are in local currencies from each party. Depending on which one (revenue or EBITDA) is more important for the two companies, we can steer the BoD’s attention towards the relative valuation scenario that favors a specific party or the other. Furthermore, we should show these revenue and EBITDA metrics as a % of what each party is bringing to the table. In a fair and equitable world, these percentages should be the base of the % equity ownership discussion, i.e. what each party is entitled to in NewCo’s equity ownership.

This is where I typically end a merger financial review presentation. I usually supplement the presentation with an Appendix that contains the original (unadjusted) stand-alone target’s P/L and the revenue synergies scenarios in greater detail (which lines of business and which party brings the revenue synergies) during the holding period (financial forecast period, usually 3 years out).

You might ask what should we expect from all of this work? Well, there are 3 possible outcomes:

The BoD sees no value in the proposed transaction and kills the effort.

The BoD sends it back with requests for more information or questions.

The BoD sees value in the proposed transaction and decides to proceed with the effort.

In my most recent one of these presentations, the BoD opted for #3 of the above options. It is a very good sign when this happens. It means that the BoD has confidence that the financial due diligence has been conducted with the right amount of rigor and that the expected outcome is a positive one. They took it to the target partner’s BoD, which argued that the target partner is entitled for more of the % equity ownership of NewCo. This is to be expected and sometimes this type of negotiation bears positive fruits. When it does so, the parties involved typically move on to the next stage: even deeper financial diligence or the start of deal structuring and integration planning.

This is where we wrap up on merger relative valuation. I thought having the whole template might help some of you readers, so it is attached here. Please send me your thoughts and questions.