Board of Directors Shareholders' Monthly / Quarterly Report

It is very common for a Corporate Strategy & Development person (especially those with cross-functional project management background) or a CEO’s Chief of Staff to be tasked with the responsibility of generating a monthly / quarterly report of some sort for the executive team, the Board of Directors (BoD), or both. Some Corporate Strategy & Development teams create a specific function for this role, others roll it into other job descriptions - typically at the managerial or director level. In this blog post, I will cover what a monthly / quarterly shareholder report would look like at a private mid-size company. The more mature / larger the company, the more sophisticated these reports look like, and vice versa. A startup would have a much simpler report format, and a conglomerate would have more sophisticated metrics to report. For example, it is common for conglomerates’ monthly / quarterly shareholder report to have a section on investments returns on invested capital (ROICs) and multiples on invested capital (MOICs).

To begin the report, there are typically five common updates in the monthly shareholder report: financial, sales & marketing, operational, technology, and legal updates. These updates are necessary as they inform the BoD on the likely health status of the company (and by extension, the BoD’s investments in the company). There might be a tendency for some executive teams to highlight successes and downplay setbacks. While everything is relative, I do believe that some issues benefit from the involvement of members of the BoD. Issues such as getting through the executive introductions or decision-making at a potential clients’ (a BoD member might know the right people), class action lawsuit (a BoD member might have encountered something similar before), and so on. The point is, it is good to balance the positives and the negatives.

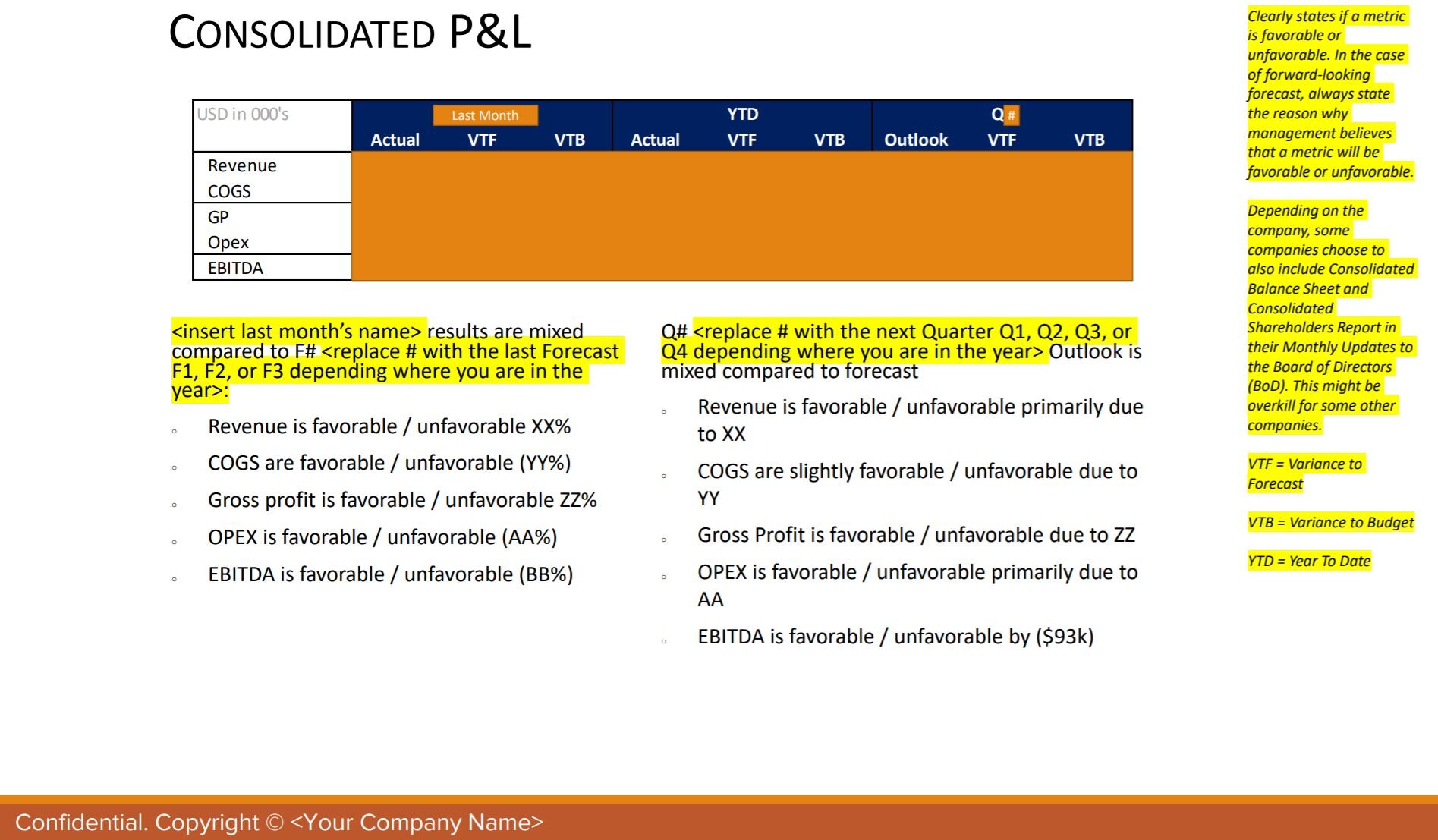

The Financial Update section typically starts with the presentation of the consolidated P/L (or income statement). Revenue, COGS, OPEX, and EBITDA are usually presented in three periods of time: last month, present year-to-date, and future quarter outlook. In some companies, present quarter-to-date is presented instead of future quarter outlook. For historical information, three different types of numbers are usually presented: actual or outlook (newest forecast), variance to forecast (VTF), and variance to budget (VTB). The difference between budget and forecast basically lays on where we are in the company’s financial year. At the start of a company’s fourth quarter in it’s financial year, the BoD is typically presented with a projection of revenue and expenses for the following financial year. When the BoD approves it, that projection becomes the budget. At the end of the first quarter of the following financial year, the company’s financial team would review what has been accomplished in the first quarter and fine tuned the projection for the upcoming quarter and the rest of the year. The result of this finetuning is the Forecast 1 (or F1 for short) and the activity gets repeated two more times during the financial year to yield F2 and F3. When presenting the consolidated P/L, it is always helpful to note if specific items in the P/L are trending towards favorable or unfavorable, and if appropriate, the causes of these trends. Lastly, some companies (especially the larger ones) also choose to present a consolidated Balance Sheet and a Consolidated Cash Flow Statement in their monthly report. Depending on the company, this inclusion might be overkill (with the exceptions for public companies’ SEC-regulated quarterly filings).

The next few items in the financial update are typically reviews of P/L components: top-line Revenue, bottom-line profit, COGS, and OPEX (SG&A). They usually follow a straightforward, predictable format:

A bridge walkthrough bar chart of actual vs. forecast, and the causes of their variances.

Favorability or unfavorability of key drivers, and their causes.

Any offsetting factors and their causes.

In small- to midsize companies where there is a need to optimize the use of cash, sometimes a slide for the company’s headcount would also be included. Typically, a month-by-month view of headcounts by department is presented along with a forecast and the variance to forecast (VTF). Also, it is common to comment on the favorability and unfavorability of hiring, the number of open positions, and the size of temporary staff that augments the employee base.

The Financial Update section can be concluded in a variety of ways. One of which is by presenting a view of the short term cash flow. This is very common - especially so when a company is in need of cash infusions from its shareholder to keep operations going, when there is a need for another funding round, or when there is an extraordinarily large upcoming payment due. Typically, this section showcases monthly cash flow from operating and financing receipts, followed by operating and financing disbursements - both actual and projected. The Financial Update section is one that should be put together in collaboration with the CFO, the Controller, and the head of FP&A (Financial Planning & Analysis) offices.

The next section of the monthly/ quarterly shareholder report that we’ll cover in this post is the Sales & Marketing Update. This section requires the collaboration of the Chief Sales & Marketing Officer(s) or heads of Business Developments. It is meant to inform the BoD of the state of the business from a growth perspective: world wide and region-by-region customer counts, their variances to forecast and to budget, and the year-over-year (Y/Y) growth or decline. It is common to showcase last month’s view along with year-to-date (YTD) view.

Next in this Sales & Marketing update section is the geography-by-geography contexts: for each large potential customers and/or large projects worked on in the previous month / quarter, the management team should inform the BoD of the following:

Any milestone accomplishments.

Any meaningful obstacles.

Any significant lessons learned.

Planned activities for the upcoming month.

Any resources (beyond what was planned already) that are still needed.

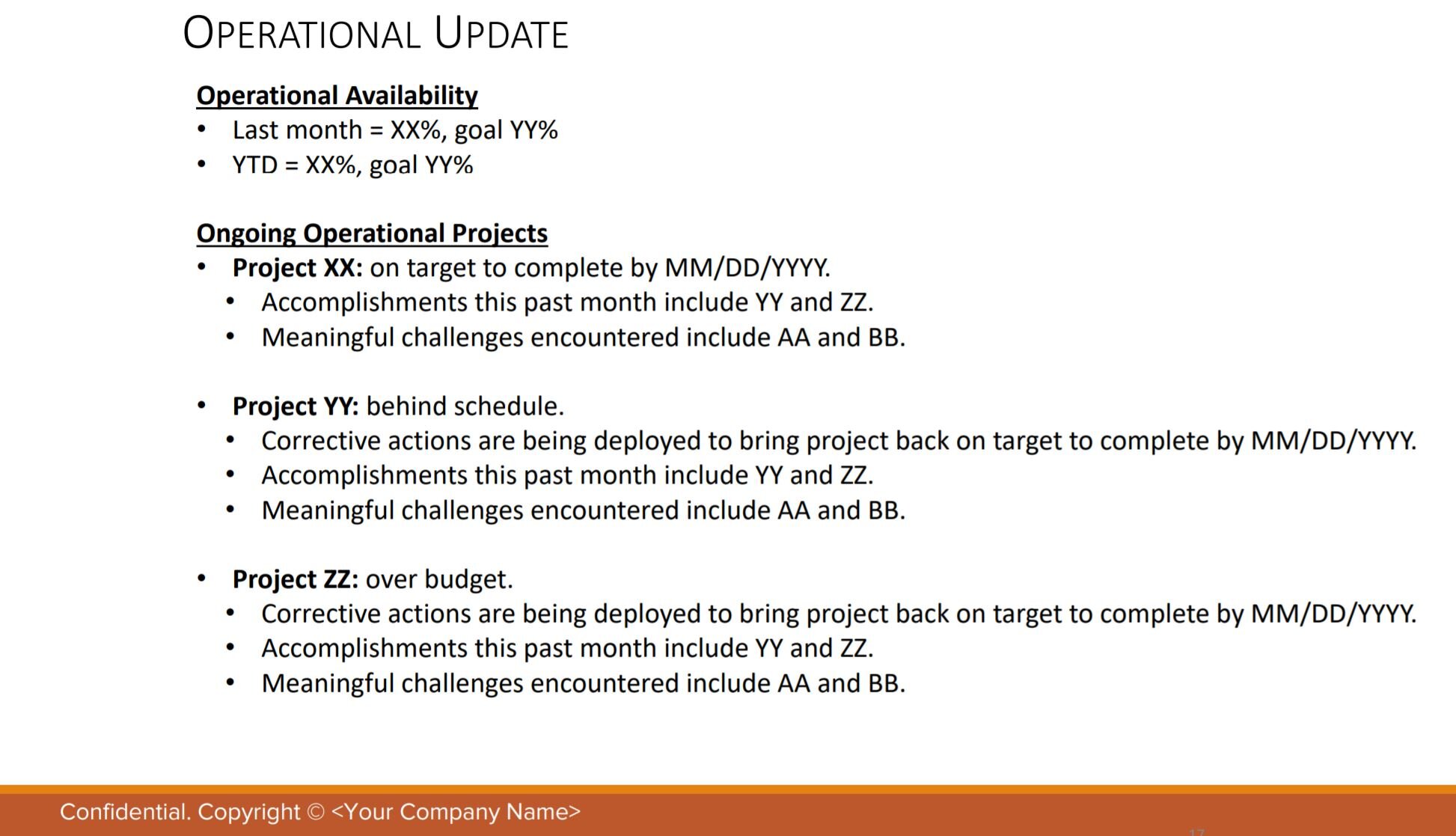

The next section is the Operations update. This section requires the collaboration of the Chief Operations Officer. It is typically meant to update the BoD on the availability of service (towards the end customers / clients) - actual vs. goal, both in the past month / quarter and year-to-date. It is also a good section to inform the BoD of any ongoing (large) operational projects. Specifically, which project(s) are on target, behind schedule, and over budget. While the BoD might not be able to help with any of them, it is still a good information-sharing mechanism - especially if any of the projects are strategic in nature.

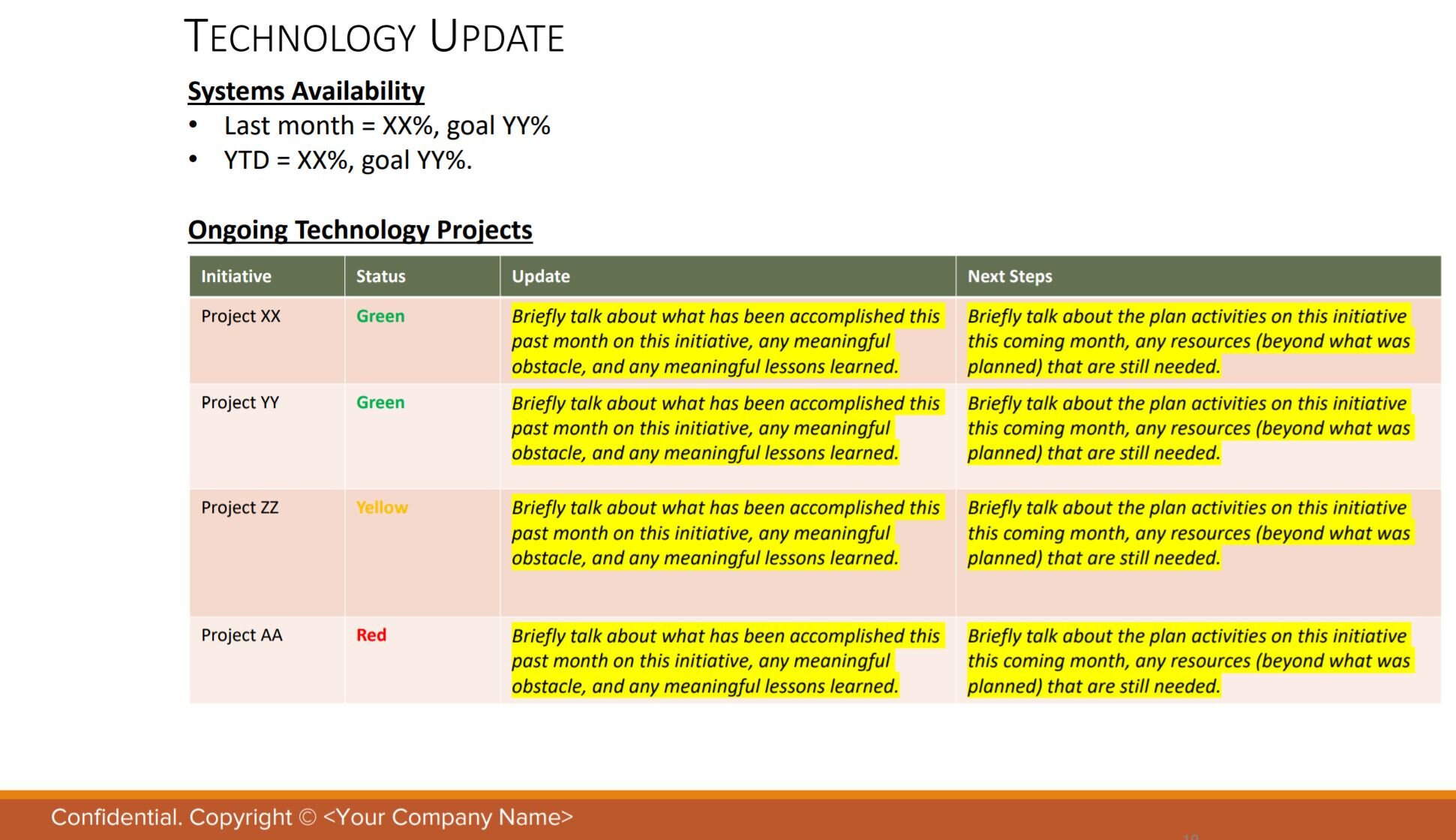

The Technology update section is next. This section typically requires the collaboration of the Chief Technology Officer. Similar to the Operations update section, this part is meant to update the BoD on the availability of systems (towards Operations) - actual vs. goal, both in the past month / quarter and year-to-date. It is also a good section to inform the BoD of any ongoing (large) technology projects. Especially as technology projects tend to be expensive and labor consuming. This is a good section to inform which project(s) are on target, behind schedule, and over budget. As with the Operations update, while the BoD might not be able to help with any of the issues, it is still a good information-sharing mechanism. A note on the Technology update section: in the past few years, as more and more cyber security issues emerged, companies have been using this section to update their BoD of any security breaches that occurred. Especially when the companies in question are technology companies or if the companies hold sensitive consumer data, such as PHI, credit card numbers, or other sensitive information. Several years ago, I observed a monthly shareholder report with 3 slides detailing the last phishing attack the company has recently experienced. It made sense that the company shared the instance as they were a technology company who holds PHI data and had been under-investing in their IT security mechanisms. It also made sense that after that report, the BoD approved an additional budget to beef up IT security against hackers.

The Legal update section is next and last in the monthly / quarterly shareholder report. This section requires the collaboration of the Chief Legal Counsel (corporate attorney) and can be blank if there is no significant legal matter to report. Significance is typically set differently in each company, however, the usual legal matter to report here can range from a large class action lawsuit, labor dispute, (shareholders) operating agreement revision update, compliance issues, and so on. I have even seen one company who used this section to educate its BoD on the topic of fiduciary duties. It made sense for that company at that time as their BoD just went through a revamp with members who have been there for decades retiring and turning over the batons to new representatives. However this section is used, it is always good to have the label “Attorney/Client Privileged” in the report header to explicitly protect the content beyond confidentiality rules.

One last note before we wrap up the Monthly / Quarterly Shareholder Report: many companies spend too much time putting together this report and not enough time improving the business based on the information gathered for the report. A good BoD should be able to catch this tendency and influence / steer the company’s management team towards better execution.

We are now done with this topic. I thought it might help some of you to have the complete template, so it can be downloaded here. Please feel free to email me your thoughts and feedback. I look forward to hearing them and seeing you in the next post!