M&A Blog #13 – sell-side acquisition (execution)

Once the preparation (pre-marketing) phase is completed, we enter the significantly less heavy marketing phase. This phase consists of contacting selected professionals at the potential buyers with a confidential inquiry. Typically a CFO, a corporate development director, or in some cases the CEO, would be approached with the acquisition opportunity. The seller’s advisors will pitch the target company, highlighting the most attractive elements of the opportunity, the target’s performance and market position, the investment thesis and fit with the prospective buyer, the details of the sales process, and next steps.

Once there is an interest from the prospective buyer, a confidentiality agreement will be provided to the buyer for the signatures. The document serve to keep the discussions confidential between parties, limit distribution to those who need to know within the buyer’s organizations, and protect sensitive information contained in the CIM (offering memorandum) from being distributed outside the company.

After the prospective buyers review the CIM and conduct their own preliminary diligence analyses to determine their level of interest and initial valuation of the sale, they will typically solicit internal support for the acquisition. The ones with enough support will then provide non-binding indication of interest letters that outline their terms.

On the seller’s side, the shareholders (as represented by the board of directors), the management, and the seller’s financial advisor should evaluate all of the terms and conditions to select 2-3 parties to engage in further due diligence. The comparisons can be based on several factors:

Valuation:

Total value, structure, contingencies, forms of payment (cash, buyer’s stocks, target’s stocks, seller’s notes, post-transaction debt, and more), and deferred payments (payments based on future performance) should be evaluated.

Structure:

Liquidity, new terms of equity arrangement, potential upside associated with any deferred component can make the transaction more complex.

Execution Risk:

Likelihood of the deal closing on the terms of the offer, buyer’s commitment and motivation to see the acquisition through, the amount of buyer’s diligence and homework, the effect of sharing confidential information with a particular acquirer versus other prospects, financing in place (or related contingencies), and the buyer’s track record of following through with its offer should be used as evaluation criteria.

Time to Close:

The buyer’s due diligence requirements, length of anticipated closing, and experience with an established acquisition process (as opposed to being a first time buyer with an uncertain approach) should be factored in.

Other Issues:

The buyer’s plan for local facilities (maintain versus close), corporate cultures, and customers reaction to the sale to a particular buyer should also be considered - especially if there are any earn-out contingencies based on future performance metrics.

From the seller’s point of view, it is worth noting that it is significantly better to select a simple, clearly outlined transaction with a slightly lower valuation than complex ones that offer slightly higher price for the target. The reason for this is time. Complex transactions take time to close, increase risks of not closing the deal, and may make it harder to realize synergies post-close. A simple, clear transaction increase the chance for success on both closing and synergies realization.

Once the seller selects the prospective buyers to engage in due diligence, the prospects will meet with the target’s management team and discuss the company’s prospects and strategic fit. Further due diligence (known as confirmatory diligence) occurs for the buyers to hone their offers and prepare a full set of terms in preparation for an acquisition. It is ideal to have multiple buyers at this stage to increase competitiveness for the target, an element that usually drive up the price in favor of the seller.

At this stage, the buyers typically look to develop their financing in dialog with their investment and commercial bankers. The existence of financing enhances an offer, showing to the seller that the buyer has a credible bid. The buyers will usually ask their primary financiers to confirm available credit / funds in a financing support letter. On the seller’s side, having this letter will reduce risks of the deal not closing. Once the final bids are submitted by the prospective buyers, the seller (management and board) and its financial advisors meet once again to decide the winner of this targeted auction process. The winner then gets invited to the closing table.

At the closing table, the seller, the buyer, and the target enter into a definitive agreement that finalize the M&A transaction. The key purposes of this stage are to finalize the transaction, to complete necessary legal documentation, to obtain any regulatory / governmental approvals required to move forward, and to secure shareholder approval.

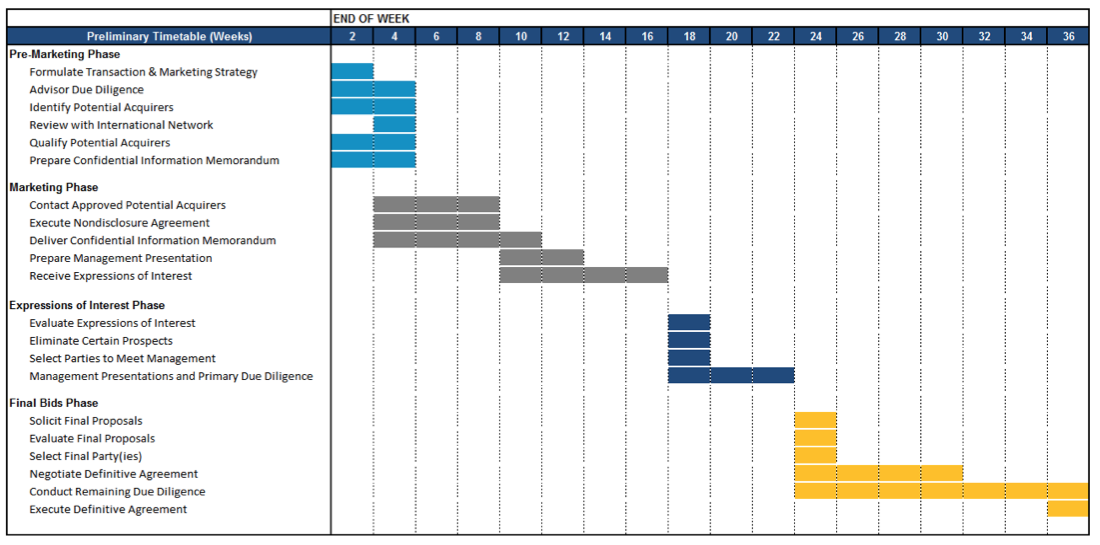

So far, we have discussed the sell-side process step-by-step in a detailed manner. It is worth having an overall sense of what should take place when and for how long:

As mentioned several times in the last two posts, time is not the seller’s friend. The longer the deal takes, the higher the probability that target’s management might get distracted and that performance will suffer, the higher the chance of the deal not closing, and the higher the chance of sensitive information leaking from the deal. It is to the seller’s best interest that the deal close quickly.

We have discussed the sell-side of an M&A transaction in the last two blog posts. The reasonings behind a sale, the preparation for a sale, the marketing process, bidding phases, and closing have all been discussed along with a “calendar” of what the process should look like. The process is fairly straightforward and differ only slightly from the process of selling a real estate property. In future posts, we dive deeper into buyer’s valuation and due diligence that manifests in final bids for an acquisition.